French online music streaming platform Deezer has pledged to turn in a profit by 2025 as its losses narrowed by €8.8 million ($8.5 million) in the first half of the year.

That’s according to the company’s half-year results, for the six-month period ending 30 June 2022, published on Thursday (September 22).

In the first half of the year, the company lost 300,000 subscribers as it failed to keep and attract users outside its home market. The loss was also driven by the company’s exit from the Russian market at the end of the first quarter.

Spotify, in comparison, added 6 million net Premium subs in the second quarter, ending the first half of 2022 with 188 million subs, compared with Deezer’s 9.4 million.

Despite the loss in user numbers, Deezer managed to rake in €219.4 million in revenue in the first half of the year, up 12.1% from a year ago. It attributed the growth to price increases that it had rolled out, as well as to a change in the company’s geographical mix.

Although the company’s losses continued to mount, its net loss in the first half shrank by €8.8 million to €51.9 million from €60.7 million in the year-ago period.

The Spotify rival, in its first-half results released September 22, said its operating losses totaled €52.6 million, down from €61.1 million in the first half of last year. In the most recent period, it recorded recorded non-recurring expenses related to its public listing.

Deezer debuted on the Euronext in July, receiving lukewarm response from investors.

However, Deezer remains bullish on its potential to turn in a profit in the next three years as it doubles down on its new B2C/B2B strategy of deepening its focus on large attractive markets via a so-called ‘partnership-first go-to-market model’.

“Deezer’s new strategy is delivering improved profitability and double-digit growth. This has been possible thanks to a strong subscriber growth in France, increased ARPU in international markets driven by our new focus, and cost discipline.”

Jeronimo Folgueira, Deezer

The company recently disclosed plans to expand in Germany by partnering with local broadcaster RTL, which was the same road that it took when it launched in Brazil in 2013 via partnerships with TIM, Globo and Mercado Libre.

“Deezer’s new strategy is delivering improved profitability and double-digit growth. This has been possible thanks to a strong subscriber growth in France, increased ARPU in international markets driven by our new focus, and cost discipline,” Deezer CEO Jeronimo Folgueira said.

Folgueira says that by focusing on large attractive markets and entering new markets with a partnership-led model, “we are convinced we can capture a fair share of the booming streaming market and continue improving our profitability to reach breakeven by 2025″.

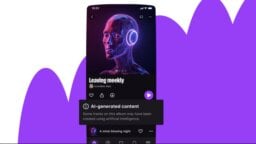

Deezer seeks to focus on product innovation and brand differentiation in its goal to attract more users globally.

France remains Deezer’s stronghold. The company’s revenue in this market rose 11.1% year over year to €132.4 million, boosted by the 10.7% jump in its B2C subscriber numbers. In the rest of the world, Deezer’s revenue climbed 13.6% in the first half to €87 million, which the company attributed to dynamic B2B sales, owing to its existing partnerships and more recent B2B deals in Brazil and Europe.

“we are convinced we can capture a fair share of the booming streaming market and continue improving our profitability to reach breakeven by 2025.”

Jeronimo Folgueira, Deezer

Deezer ended the first half of 2022 with 9.4 million subscribers globally, down 2.9% from the year-ago period.

It came as the jump in its French subscribers offset the drop in its subscriber base in the rest of the world.

“In the rest of the world, Deezer’s new strategy led to a significant reduction of unprofitable spend in non-core long tail markets, which therefore impacted the acquisition of new B2C subscribers,” the company said.

Looking ahead, Deezer expects to register a 14% jump in revenue for 2022 to €455 million as it anticipates a surge in revenue in the second half due to the progressive ramp up of RTL partnership and the incremental impact of price increases implemented throughout the year.

The company did not provide a guidance for profit or net loss for the full year.Music Business Worldwide