The MBW Review offers our take on some of the music biz’s biggest recent goings-on. This time, MBW crunches the latest numbers from the major record companies to see how Universal, Sony and Warner performed in the calendar year of 2018. The MBW Review is supported by Instrumental.

Across the whole of 2018, the three major recorded companies combined generated an average of $19m each day – or just under $800,000 per hour – from streaming services.

That’s according to new MBW research, which places our microscope on the money generated by Universal, Sony and Warner’s labels in the last calendar year.

The ‘Big Three’ turned over $6.93bn from streaming services in wholesale revenue last year, according to respective recent investor filings from UMG parent Vivendi, Sony Music parent Sony Corp and Warner Music Group, all analysed by MBW.

That was up by just over $1.6bn on the $5.3bn the trio generated from streaming services in 2017.

Overall, across all formats (and other commercial activities), the recorded music divisions of Universal Music Group, Sony’s music division and Warner Music Group turned over $13.14bn last year, which itself was up $1.04bn on the prior year.

Which of the Big Three had the most stellar year? In a word, Universal.

According to MBW’s calculations, Universal’s annual streaming revenues bounced by 39% at the US dollar level in 2018 to top $3bn for the first time.

That was a higher percentage jump than that enjoyed at Universal in 2017, when its annual streaming revenues grew by 35%.

Another way of putting it: Universal’s yearly global streaming revenues increased by a shockingly large $864m in 2018 – that’s the equivalent of an additional $2.4m every single day.

In fact, Universal’s annual streaming income nearly doubled in 2018 when compared to two years prior; in 2016, UMG turned over $1.65bn from streaming.

Warner was the second biggest streaming gainer last year, bouncing up $396m (+27.6%) on 2017’s haul from the format: Warner pulled in $1.44bn from streaming in 2017, and $1.83bn in 2018.

Sony saw its annual streaming revenues grow by $368m (+22.3%) last year, finishing with more than $2bn from the format across the 12 months.

Looking at the major record companies’ overall revenues last year, it’s clear that UMG once again made the biggest gains.

According to MBW’s US dollar-level calculations, Universal grew its overall revenues by over $600m in the year, despite declines in physical and download sales, to $5.73bn. That represented an 11.7% year-on-year jump

Sony Music, hampered by a steep decline in physical sales (down by $261m year-on-year) in a transitional year, saw its total recorded music revenues grow by a smaller margin, up 1.7% to $3.92bn.

Warner’s recorded music revenues grew by 11.8% annually, with revenues across all formats and recorded music activities hitting $3.5bn in 2018.

This figure was boosted by $76m of revenue booked in Warner’s Q4 related to its acquisition of merch company EMP – which also helped push WMG’s Q4 recorded music revenues above $1bn.

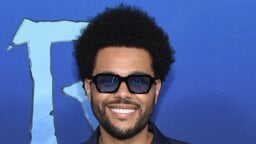

Universal’s biggest selling artists in the year included Drake (pictured), Post Malone, The Beatles and XXXTentacion.

* A NOTE ON CURRENCY CONVERSION.

MBW has used a currency conversion formula for Sony Music Entertainment and Universal Music Group which sees both company’s global revenues – originally reported by Sony in Japanese Yen and Universal/Vivendi in Euros – reversed into US Dollars.

In order to do this for 2018’s figures, we used an annual currency exchange rate provided in each case by Vivendi and Sony Corp respectively. We also applied prevailing rates provided by both parties for 2017. (For 2016, in UMG’s case, we calculated a dollar haul via annual average rates obtained from Oanda.) These prevailing average annual rates in each calendar year provides a constant currency picture of both companies’ performance.

Warner Music Group reports its results in the ‘root currency’ of USD, which we left unchanged for both 2016 and 2017.

It hopefully goes without saying that what happened after these revenues flowed into the major companies – including the proportion that was paid back out to their independent label and artist distribution partners – is not reflected in these figures.