Yesterday we were told that 2014 had been an exceptional year for Australian artists in their home country.

According to ARIA’s Top 100 End of Year Charts, Aussie artist representation in both the singles and albums listings showed significant growth on the prior two years.

Australian artists claimed 18 tracks in the ARIA Top 100 Singles Chart of 2014 – five more (+38%) than the previous year and seven more (+64%) than in 2012.

They did notably well in albums too, with 36 local releases charting in the ARIA top 100, nine more than the previous two years (+44%).

In the UK, there was similar cause for national pride just a few days before – even more so.

According to the BPI, British artists claimed all spots on the Official Top 10 bestselling albums of the year – led by Ed Sheeran’s second LP, X, which also topped the list in Australia.

Compared to the rest of the major music territories, however, Aussies and Brits lag behind some others when it comes to love for local artists…

JAPAN

The undisputed king of the globe for loyalty to its own acts is the Japanese market.

Throughout the past five years, the share of the country’s CD singles sales taken by Japanese acts has stood at a resolute 98%.

(RIAJ figures regarding local/international repertoire in Japan tend to concentrate on physical sales – which make up 87% of the Japanese market by value.)

In the albums market, English-speaking breakthroughs such as Adele have helped make the buying public less locally obsessed, but not by much: 2013 and 2012 both saw a five-year high for Japanese artists’ share of the CD album market at 76%.

In 2013, the last full year on record, 85% of Japan’s total recorded music market value was taken by domestic artists, up from 84% in 2012.

The percentage that domestic repertoire generated for the total of audio recordings market – including music videos – remained unchanged at 85%.

FRANCE

France’s local body SNEP only monitors the country’s total physical market, by units, in terms of international vs. local repertoire – but it still gives an important indication of how French artists are treated in the country.

SNEP’s figures show a market becoming increasingly loyal to French artists, with 2009’s 60% market share for local acts climbing to 70% in five years.

According to other SNEP figures, of the total recorded music market income for France, local artists generate the majority – 64%.

In 2013, eight of the Top 10-selling albums in France were by French acts.

The secret to French local artists holding more of a share of their own market than the British? Well, the language barrier obviously helps.

But the Pelchat amendment to the 1994 Broadcasting Reform Act in France also means that French radio has to play 40% French-language music by law. As you can see in the chart below – representative of physical unit sales of all types of music – it gets results.

GERMANY

The presence of German artists in the country’s annual Top 100 singles market has been slowly eroded by the influx of hits from the US and UK.

From a 53.2% share of unit sales amongst the Top 100 in 2006, just seven years later in 2013, German artists claimed considerably less of a stake, according to BVMI/GFK stats – down to 38%.

But the country’s annual Top 100 albums market tells a very different story. In fact, the opposite is true: nine years after 2004’s measly-looking 39% share of the Top 100’s total unit sales, the share of German artist albums grew to 61% in 2013.

Of the Top 10-selling albums of 2013 in Germany, seven were German language.

UK

Looking at the Official Charts Company’s publicly-announced Top 40 singles each year, we can see that British artists have rather found their level in the past four years, even if it’s subservient to artists from the US and elsewhere.

British artists as lead acts on tracks have only taken between 45% and 48% of the annual UK Top 40 singles market from 2011-2014 – handing a majority of sales to artists from outside the territory Things have definitely improved since 2010, though, when UK acts only claimed 11 tracks of the Top 40 as lead artists (28%).

The higher up you go in the UK singles chart, the more US artists begin to dominate: in 2010, 2012 and 2013, UK acts could only claim two (20%) of the Top 10-selling singles in the country.

2014 brought better news for UK acts, with four (40%) of the year’s Official Singles Top 10 – Clean Bandit’s Rather Be, Ed Sheeran’s Thinking Out Loud, Ella Henderson’s Ghost and Sam Smith’s Stay With Me – created by local artists.

However, one shocking stat looms large: in the ten years since the launch of iTunes in the UK in June 2014, the top ten downloads contained just one British song – Adele’s Someone Like You.

The publicly-available Top 40-selling albums of each year from the Official Charts Company show much better news for British acts in the UK.

Since the release of Adele’s 21 in 2011 – which helped raise UK acts’ share of the annual Top 40 from 50% to 65% – things have remained pretty constant in the mid-60s percentage-wise for British artists.

US

The publicly-available bestsellers charts from Nielsen Soundscan in the US only tend to stretch to a Top 10. But with 2014’s stats out today, at least we’re up-to-date.

If you include the Frozen soundtrack, then US artists took 70% of the Top 10 selling albums in 2014, down from 2013’s clean sweep – when all of the Top 10 was claimed by US artists.

US acts tend to claim a healthy majority of the top downloaded/digital singles market too. From a dip of 60% in 2012, their market share stood at nine of the Top 10 in 2013 and seven of the Top 10 in 2014.

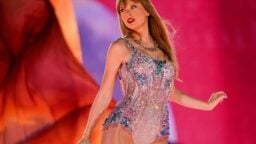

[Pictured: Sam Smith, who scored the biggest album by a non-US artist in 2014 with debut In The Lonely hour, which shifted 1.3m copies – only being outsold by the Frozen OST and Taylor Swift’s 1989]Music Business Worldwide